|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Mortgage with 500 Credit Score: What to Expect and How to ProceedRefinancing a mortgage can be a strategic move for homeowners seeking better terms or lower interest rates. However, if you have a 500 credit score, the path to refinancing may present unique challenges. Understanding what to expect and how to navigate this process can make all the difference. Understanding Credit Scores and Their ImpactYour credit score plays a crucial role in determining your eligibility for refinancing. A score of 500 is considered poor, which can limit your options significantly. What Lenders Look ForLenders assess your credit history, income, and equity in your home. With a low credit score, it's essential to demonstrate reliability in other areas. Exploring Your Refinancing OptionsDespite the challenges, there are ways to refinance your mortgage with a low credit score. FHA Streamline RefinanceIf you currently have an FHA loan, you might qualify for an FHA Streamline Refinance, which requires less documentation and no appraisal. Consider a Co-signerAdding a co-signer with a higher credit score can improve your chances of approval and potentially secure better terms. For those in Texas, the texas no cash out refinance option might be worth exploring, as it offers specific benefits for state residents. Improving Your Credit ScoreWhile pursuing refinancing, it's wise to work on improving your credit score.

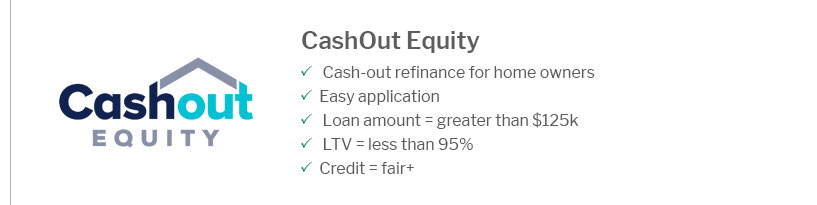

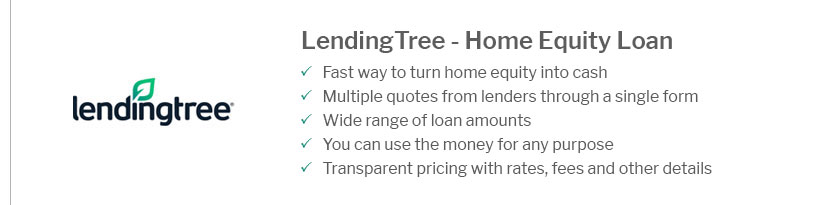

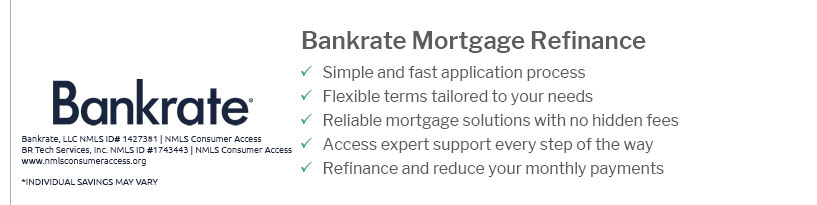

Choosing the Right LenderFinding the right lender is crucial, especially with a low credit score. Researching and comparing different options can lead to more favorable terms. For instance, you can explore the top online refinance lenders to find competitive rates and tailored options that suit your situation. Frequently Asked Questions

https://www.lendingtree.com/home/refinance/refinance-with-bad-credit/

FHA lenders offer refinance loans with scores as low as 500, but they charge higher interest rates to offset the risk that you might not be able to make the ... https://balanceprocess.com/cash-out-refinance-500-credit-score/

FHA Loan | Cash Out Refinance with 500 Credit Score - 500 credit score minimum - Borrow up to 80% of your home value - No accounts in dispute on ... https://www.credible.com/mortgage/credit-score-needed-to-refinance-house

As long as your new loan-to-value ratio is 90% or lower, you'll only need a 500 credit score to qualify for an FHA refinance. If it's higher than this, a 580 ...

|

|---|